Flood Insurance: Don’t Get Caught Underwater

/Homebuyers have a lot to think about and do in the time between signing a purchase contract and closing on their dream house. Arguably, the most important is to get the money from a lender so they have the funds to make the purchase.

A lender will only provide money for closing if: (a) the buyer is creditworthy, (b) the home has an appraised value that supports the contract price and (c) if the home can be insured. These three simple things each has its own surprising details. None so much as ‘can the home be insured?’.

While people are right to focus their attention on inspections and the appraisal, the survey is often forgotten or viewed as a cursory step. While usually the case, if unforeseen things come up, a problem survey can be monumentally challenging to the closing.

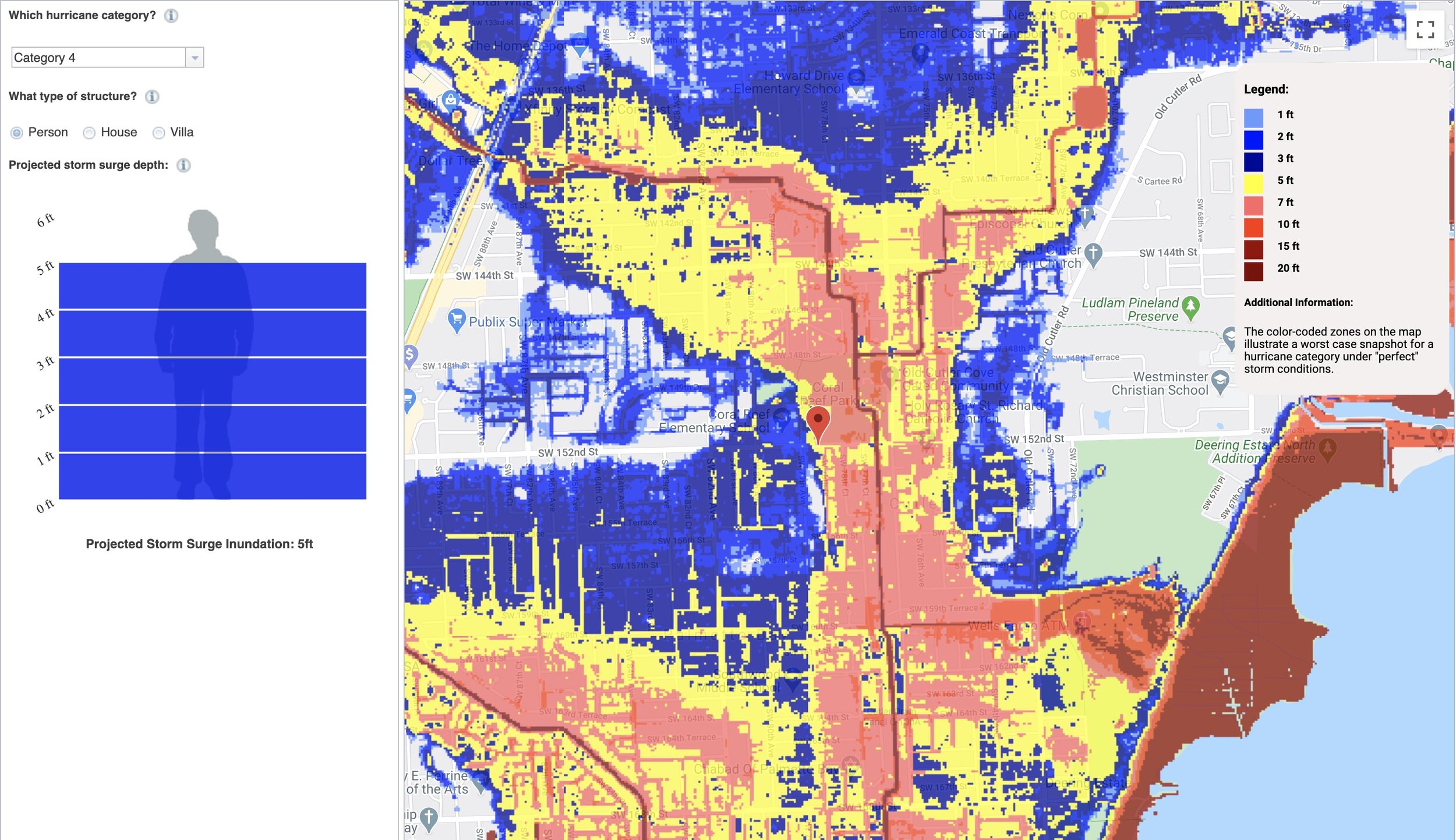

Insurance for a home includes general hazard, windstorm and flood insurance, each often needing to be sourced piecemeal rather than from one insurer. Flood insurance, which is this article’s focus, is required for any Federally-backed mortgage in a special flood hazard area and is usually a stand-alone policy. In South Florida, more than 3/4ths of homes require flood insurance.

So, boiling it down to its simplest form, no flood insurance policy equals no home purchase for a homebuyer who is also a borrower. The problem is, the cost of flood insurance is rising and can sometimes blindside the buyer and kill a real estate deal.

Michael Reyes is President at FIB Insurance and an 18+ year veteran of the insurance business. Michael explains, “We’ve recently seen real estate contracts that can’t close because flood insurance throws a curveball. Mostly, it is a quote that is much higher than anyone expected and that throws off the buyer’s ratios, but it could also be an unexpected survey result showing a lower base flood elevation.”

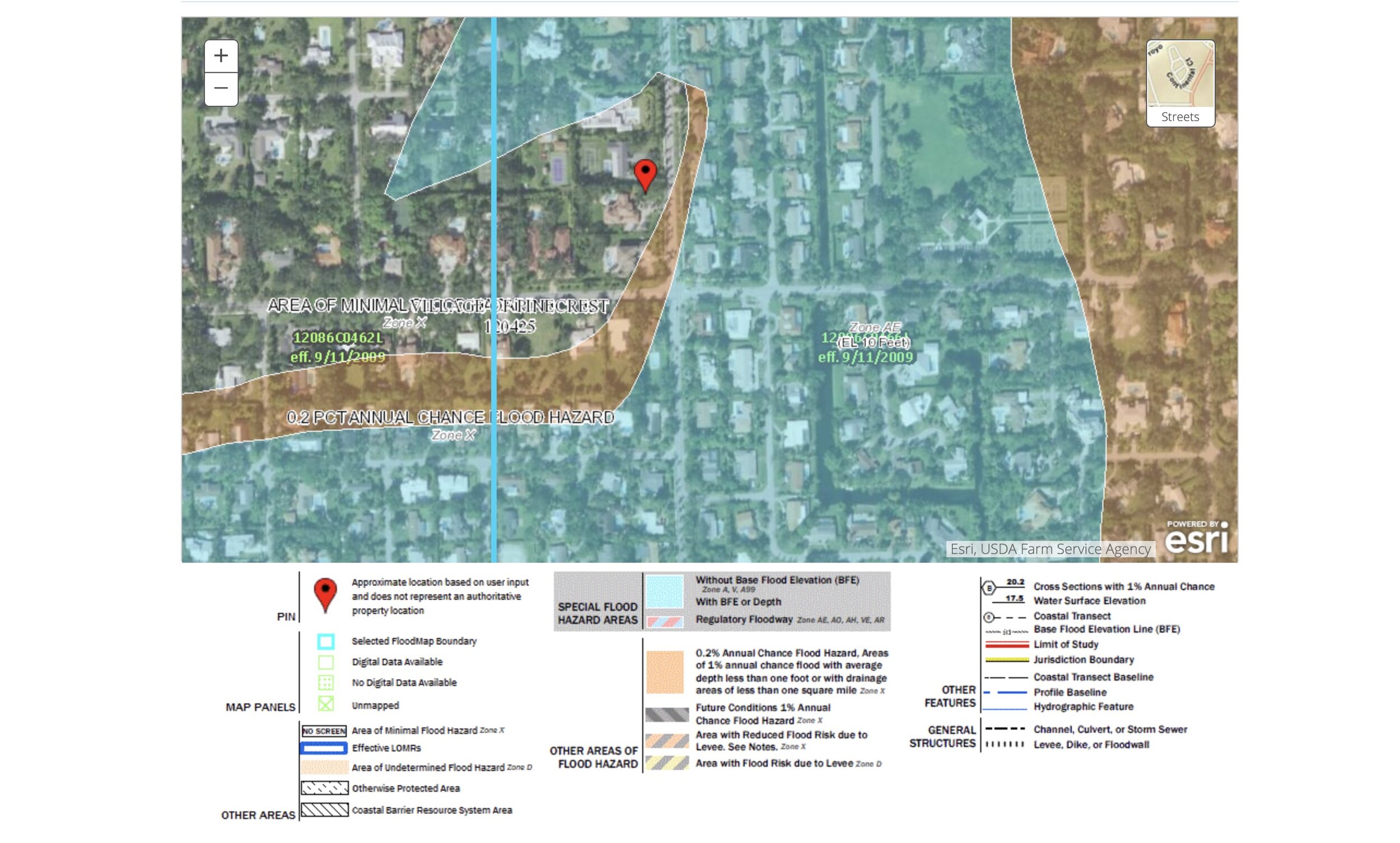

Regardless of flood coverage, insurance rates are dictated by what is stated on a Flood Elevation Certificate. During the lending process, a flood elevation certificate is obtained when the lender hires a surveyor to make sure that the property boundaries are correct, that no man-made structures cross a boundary and that the elevation of the land and home are accurate. And, although anyone can use http://msc.fema.gov to see what the government survey says is any home’s elevation, it is not official or actionable for a flood policy until a flood elevation certificate is obtained. In short, the Flood Elevation Certificate dictates insurance coverage.

Over the last couple of years, there are more options available for flood insurance than just going to the National Flood Insurance Program (NFIP). Reyes explains, “There are private flood markets that are offering policies that are often less expensive and can even offer more coverage than the NFIP.” [Expert Existing Homeowner Tip:] If you have an existing flood insurance policy with the NFIP, now would be a great time to get in touch with an insurance broker to see if you can take advantage of a new private market policy. The NFIP caps at $250,000 coverage, so for larger homes this is insufficient and Reyes suggests homeowners consider layering coverage for more protection, up to full replacement value.

On average, flood insurance in South Florida is about $500/year. This can vary widely depending on your home’s elevation, but the average is $500/year. When a home is sold and a new buyer gets a new flood policy, the insurance company accurately assesses the property’s risk. Often homebuyers get flood insurance quotes back at a price much higher than anticipated. This can change their monthly payment significantly enough to not allow them to qualify for the loan in the first place.

In particular, Reyes has noticed that homes in Palmetto Bay in particular are coming back with rates around $2000. This is far above neighboring communities. He can’t say why, but it does seem to correspond to the municipality and potentially the way homes in Palmetto Bay were built.

“There have been periodic revisions to the flood map over the past five years or so,” remarks Reyes. “This gets interesting because some homeowners who are mid-term through their loan and suddenly find themselves unable to continue their flood policy.” New flood maps can also increase rates, since more sophisticated flood modeling tends to uncover higher risk factors and thus rates go up. Also, there is a natural updraft in insurance costs, which have averaged about 20% over the past five years.

The big picture is that flood insurance should not be an afterthought for any homeowner. It is important during the home purchasing process and throughout home ownership. If you would like to explore your insurance option, please contact Michael Reyes, President of FIB Insurance at 305-218-6026 or mreyes@fibrokers.com.